Īdditional information can be found at 234 1st Street, San Francisco, CA 94105 Interest rates are variable and subject to change at any time. Members without direct deposit will earn up to 1.20% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum direct deposit amount required to qualify for the 4.40% APY for savings. *SoFi members with direct deposit can earn up to 4.40% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

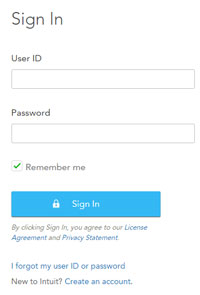

#Log in to turbotax license

pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted.

The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A. SoFi® Checking and Savings is offered through SoFi Bank, N.A. Information on SoFi Wealth available in the firm's Form ADV Part 2 Brochure on the SEC's website. Clearing and custody of all securities are provided by APEX Clearing Corporation. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Neither SoFi nor its subsidiaries are a bank. SFS, SFW, and SDA are affiliated companies under the common control of Social Finance, Inc. including SoFi Money™, advisory services offered through SoFi Wealth LLC (SFW) an SEC Registered Investment Adviser, and cryptocurrency services offered through SoFi Digital Assets, LLC (SDA). "SoFi Invest" is the brand name for brokerage products and services offered through SoFi Securities LLC (SFS) Member FINRA Opens A New Window. Consult with a qualified tax advisor or attorney. SoFi doesn’t provide tax or legal advice. It cannot guarantee profit or fully protect against loss in a declining market. )ĭiversification can help reduce some investment risk. SoFi loans are originated by SoFi Lending Corp., NMLS # 1121636. Licensed by the Department of Business Oversight under the California Financing Law License No. SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers such as Income Based Repayment or Income Contingent Repayment or PAYE. Rates and Terms are subject to change at anytime without notice and are subject to state restrictions. If approved, your actual rate will be within the range of rates listed above and will depend on a variety of factors, including term of loan, a responsible financial history, years of experience, income and other factors. To qualify for the lowest rate, you must have a responsible financial history and meet other conditions. Not all borrowers receive the lowest rate. citizen or permanent resident in an eligible state and meet SoFi's underwriting requirements. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. Next, follow the on-screen instructions to select the information you wish to include.įor additional tax information on specific SoFi Products, please visit the product-specific pages below.

#Log in to turbotax password

In the Apex Password field, you will enter the Tax ID number that is associated with the account.For example, account XXX-12345 would enter XXX12345 as your username. In the Apex User ID field, you will need to enter your account number.

If you do not utilize Apex Online, then you will need to follow these steps. If you already use Apex Online, then you will use those credentials to import your Consolidated 1099 data into TurboTax.

0 kommentar(er)

0 kommentar(er)